Here we are going to discuss the Quadrant Future Tek Limited IPO Detail and Review

Quadrant Future Tek Limited IPO is a book built issue of Rs 290.00 crores. The issue is entirely a fresh issue of 1.00 crore shares.

Quadrant Future Tek IPO bidding opened for subscription on January 7, 2025 and will close on January 9, 2025. The allotment for the Quadrant Future Tek IPO is expected to be finalized on Friday, January 10, 2025. Quadrant Future Tek IPO will list on BSE, NSE with tentative listing date fixed as Tuesday, January 14, 2025.

About the Company

Company was incorporated as ‘Quadrant Cables Private Limited’ on September 18, 2015 at Mohali as private limited company under the Companies Act, 2013. Thereafter, the name of our company was changed from ‘Quadrant Cables Private Limited’ to ‘Quadrant Future Tek Private Limited.

Company is engaged in the business of manufacturing of speciality cables and design, development & manufacturing of embedded systems for railway signalling & train control applications.

The company has a facility in Village Basma, Tehsil Banur, Distt Mohali, for manufacturing, testing, and developing speciality cables and hardware for the Train Control & Signalling Division.

The company is technology-driven, with products that meet ISO, IRIS, and TS standards and follow strict Quality Management Systems for speciality cables.

Key Awards, Accreditations and Recognition:

Our Company has not received any key awards, accreditation, and recognition.

Competitive Advantage :

- The Company is engaged in the innovation and technological development of Automatic Train Protection Systems.

- Entered an exclusive Memorandum of Understanding with RailTel to pursue KAVACH opportunities in Indian Railways and other countries’ railways.

- In-house design and product development capabilities powering our Rail Signalling Products & Solutions.

- Advanced cable manufacturing technology that meets strict standards for Railways, Naval Defence, Renewable Energy, and Electric Vehicle sectors.

- Advanced manufacturing facilities with a diverse range of power and control cables with a focus on innovation and cost competitiveness.

Objects of the Issue (Quadrant Future Tek IPO Objectives)

The Company proposes to utilise the Net Proceeds from the Issue towards the following objects:

- Funding long-term working capital requirements of the Company;

- Capital expenditure for the development of Electronic Interlocking System;

- Prepayment or repayment of all or a portion of outstanding working capital term loan availed by the Company; and

- General corporate purposes.

- Quadrant Future Tek Limited IPO Detail and Review

Quadrant Future Tek IPO Details

| IPO Date | January 7, 2025 to January 9, 2025 |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price Band | ₹275 to ₹290 per share |

| Lot Size | 50 Shares |

| Total Issue Size | 1,00,00,000 shares (aggregating up to ₹290.00 Cr) |

| Fresh Issue | 1,00,00,000 shares (aggregating up to ₹ 290.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 3,00,00,000 shares |

| Share Holding Post Issue | 4,00,00,000 shares |

Quadrant Future Tek IPO Timeline (Tentative Schedule)

Quadrant Future Tek IPO opens on January 7, 2025, and closes on January 9, 2025.

| IPO Open Date | Tuesday, January 7, 2025 |

| IPO Close Date | Thursday, January 9, 2025 |

| Basis of Allotment | Friday, January 10, 2025 |

| Initiation of Refunds | Monday, January 13, 2025 |

| Credit of Shares to Demat | Monday, January 13, 2025 |

| Listing Date | Tuesday, January 14, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on January 9, 2025 |

Quadrant Future Tek IPO Lot Size

Investors can bid for a minimum of 50 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 50 | ₹14,500 |

| Retail (Max) | 13 | 650 | ₹1,88,500 |

| S-HNI (Min) | 14 | 700 | ₹2,03,000 |

| S-HNI (Max) | 68 | 3,400 | ₹9,86,000 |

| B-HNI (Min) | 69 | 3,450 | ₹10,00,500 |

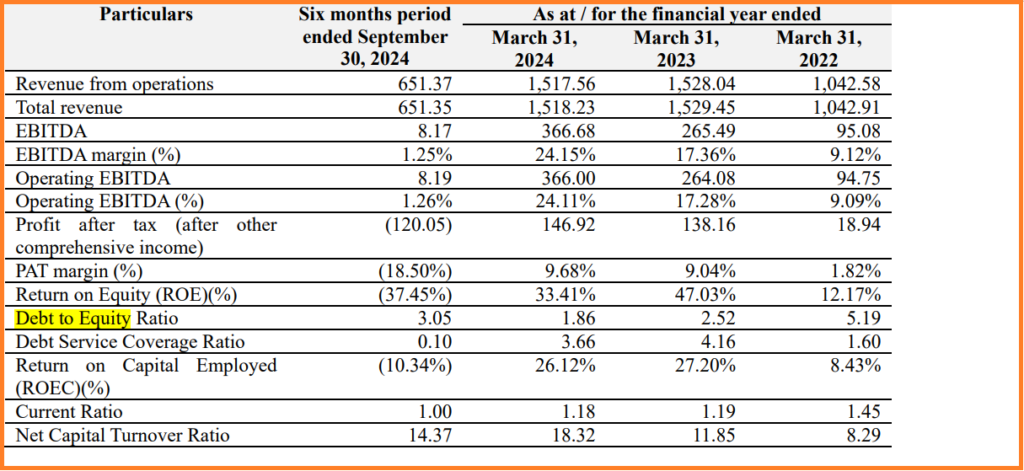

Key Performance Indicator

The market capitalization of Quadrant Future Tek IPO is Rs 1160.00 Cr.

KPI as of Sun, Mar 31, 2024.

a) Revenue from Operations means the Revenue from Operations as appearing in the Restated Financial Statements.

b) EBITDA refers to earnings before interest, taxes, depreciation, amortisation, gain or loss from discontinued operations & exceptional items.

c) EBITDA Margin refers to EBITDA during a given period as a percentage of revenue from operations during that period.

d) Operating EBITDA refers to EBITDA less other income i.e. only revenue from operations.

e) Operating EBITDA Margin refers to operating EBITDA during a given period as a percentage of revenue from operations during that period.

f) Net Profit Ratio/Margin quantifies our efficiency in generating profits from our revenue and is calculated by dividing our net profit after taxes and other comprehensive income by our revenue from operations.

g) Return on equity (RoE) is equal to profit after tax for the year divided by the total equity during that period and is expressed as a percentage.

h) Debt to equity ratio is calculated by dividing the debt (excluding lease liabilities) by total equity (which includes issued capital and all other equity reserves).

i) Interest Coverage Ratio measures our ability to make interest payments from available earnings and is calculated by dividing EBITDA by Interest and lease payments & principal repayment due in twelve months.

j) RoCE (Return on Capital Employed) (%) is calculated as EBIT divided by total equity plus non-current debt plus current outstanding of non-current debt.

k) Current Ratio is a liquidity ratio that measures our ability to pay short-term obligations (those which are due within one year) and is calculated by dividing the current assets by current liabilities.

l) Net Capital Turnover Ratio quantifies our effectiveness in utilizing our working capital and is calculated by dividing our revenue from operations by average working capital (i.e., current assets less current liabilities).

Quadrant Future Tek Limited Contact Details

Quadrant Future Tek Limited

Village Basma Tehsil

Banur,

Distt Mohali – 140417

Phone: +91 172 402 0228

Email: cs_qftl@quadrantfuturetek.com

Website: https://www.quadrantfuturetek.com/

FAQ :

Zerodha customers can apply online in Quadrant Future Tek IPO using UPI as a payment gateway. Zerodha customers can apply in Quadrant Future Tek IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Quadrant Future Tek IPO through Zerodha

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Quadrant Future Tek IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- Submit IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer :

Above information is only for knowledge purpose , please consult your financial advisor before investing.

Also read :

2 thoughts on “Quadrant Future Tek Limited IPO Detail and Review”