Subscription for Drone Destination the initial public offering (IPO) began today and will remain open until July 13, 2023. The company has indicated that the Drone Destination IPO pricing range is between $62 and $65 per equity share, and the book build issue is proposed for listing on the NSE SME platform. The top drone service provider in India hopes to raise 44.20 crore via its public offering.

About the Company :

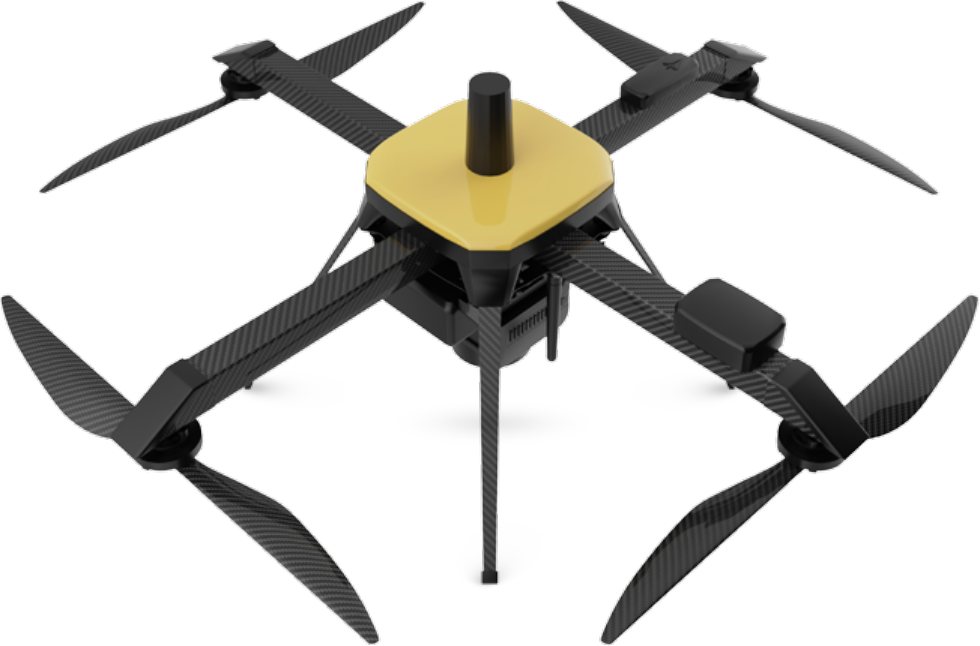

Incorporated in 2019, Drone Destination Limited is India’s leading Drone as a Service and Training Company. The entity is a DGCA-authorized Remote Pilot Training Organisation (RPTO) offering Certified training programs at multiple locations pan-India.

The company became the first Drone Training Partner of the National Skill Development Corporation (NSDC) in Oct 2022. They have the largest Training network in India in their segment. Drone Destination Limited offers a variety of services including:

- Drone-As-A-Service (DAAS) Training

- Education & Recreation

Objects of the Issue:

- To meet the expenses for the purchase of new drones.

- To meet the expenses for the purchase of the vehicle.

- To meet the Capital Expenditure Requirement.

- To meet the Working Capital requirements.

- To meet the General Corporate Purposes.

- To meet out the Issue Expenses.

Drone Destination IPO Details

| IPO Date | Jul 7, 2023 to Jul 13, 2023 |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price | ₹62 to ₹65 per share |

| Lot Size | 2000 Shares |

| Total Issue Size | 6,800,000 shares (aggregating up to ₹44.20 Cr) |

| Fresh Issue | 6,800,000 shares (aggregating up to ₹[.] Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 17,499,998 |

| Share holding post issue | 24,299,998 |

| Market Maker portion | 500,000 shares Nikunj Stock Brokers Share India Securities |

Drone Destination IPO Reservation

| Anchor Investor Shares Offered | 1,888,000 (27.76%) |

| Market Maker Shares Offered | 500,000 (7.35%) |

| QIB Shares Offered | 1,262,000 (18.56%) |

| NII (HNI) Shares Offered | 945,000 (13.90%) |

| Retail Shares Offered | 2,205,000 (32.43%) |

| Total Shares Offered | 6,800,000 (100%) |

Company Financials

| Period Ended | Total Assets | Total Revenue | Profit After Tax | Net Worth | Reserves and Surplus | Total Borrowing |

|---|---|---|---|---|---|---|

| 31-Mar-21 | 96.34 | 39.33 | -4.56 | 2.42 | -8.58 | 9,794.46 |

| 31-Mar-22 | 278.30 | 257.16 | 20.73 | 23.15 | 12.15 | 151.09 |

| 31-Mar-23 | 2,359.33 | 1,207.73 | 244.19 | 1,757.34 | 1,257.34 | 159.17 |

| Amount in ₹ Lakhs | ||||||

Key Performance Indicator

| KPI | Values |

|---|---|

| P/E (x) | 64.35 |

| Market Cap (₹ Cr.) | 157.95 |

| ROE | 13.90% |

| ROCE | 18.65% |

| Debt/Equity | 0.06 |

| EPS (Rs) | 25.8 |

Check Drone Destination IPO Peer Comparison here.

Drone Destination IPO Timetable (Tentative)

Drone Destination IPO opens on Jul 7, 2023, and closes on Jul 13, 2023.

| Event | Tentative Date |

|---|---|

| Opening Date | Friday, 7 July 2023 |

| Closing Date | Thursday, 13 July 2023 |

| Basis of Allotment | Tuesday, 18 July 2023 |

| Initiation of Refunds | Wednesday, 19 July 2023 |

| Credit of Shares to Demat | Thursday, 20 July 2023 |

| Listing Date | Friday, 21 July 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on Jul 13, 2023 |

Drone Destination IPO Lot Size

The Drone Destination IPO lot size is 2000 shares.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 2000 | ₹130,000 |

| Retail (Max) | 1 | 2000 | ₹130,000 |

| HNI (Min) | 2 | 4,000 | ₹260,000 |

| Lot Size Calculator | |||

Drone Destination IPO Promoter Holding

Mr. Chirag Sharma and Ms. Shashi Bala are the Promoters of the Company.

| Pre Issue Share Holding | 85.14% |

| Post Issue Share Holding | 62.31% |

The following is a list of key Drone Destination IPO information you should review before applying:

1] Drone Destination IPO GMP today: According to market watchers, Drone Destination Ltd. shares are currently trading in the grey market at a premium of 45.

2] Drone Destination IPO price: The price range for the SME issuance is between 62 and 65 rupees per equity share.

3] Drone Destination IPO date: The public offering started accepting bids today and will be available to subscribers until July 13, 2023.

4] The drone service provider SME firm, Drone Destination, hopes to raise 44.20 crore from this initial public offering (IPO).

5] Drone Destination IPO lot size: Bidders may submit their applications in lots, and each lot will contain 2000 company shares.

6] The maximum amount that can be invested in the Drone Destination IPO is 2000 firm shares per lot, hence the minimum amount needed to apply for this NSE SME IPO is 1,30,000 (65 x 2000).

7] Maashitla Securities Private Limited has been designated as the official registrar of the NSE SME IPO for the Drone Destination IPO.

8] Drone Destination IPO listing: A tentative date for the Drone Destination IPO listing is July 21, 2023. The public issue is being proposed for listing on the NSE SME exchange.

9] Review of the Drone Destination Initial Public Offering: Avinash Gorakshkar, Head of Research at Profitmart Securities, gave the Drone Destination IPO the “subscribe” label and noted that “SME IPOs have been generating spectacular returns to the allottees, especially when it relates to the themes working on Dalal Street. I anticipate a high reaction to the IPO because drone and defence are two of the most alluring themes that have benefited both investors and promoters (Droneacharya Aerial IPO, Paras Defence IPO).

Also read :

Multibagger returns by Paper stocks after their net profit increased up to 900% YoY.

1 thought on “Drone Destination IPO opens today. GMP, review, lot size, price, other details. Apply or not?”