A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed amount from their mutual fund investment at regular intervals, creating a consistent income stream. This is done by the fund house redeeming the necessary units from the investor’s holdings to generate the specified withdrawal amount. The remaining investment continues to grow, potentially benefiting from market appreciation.

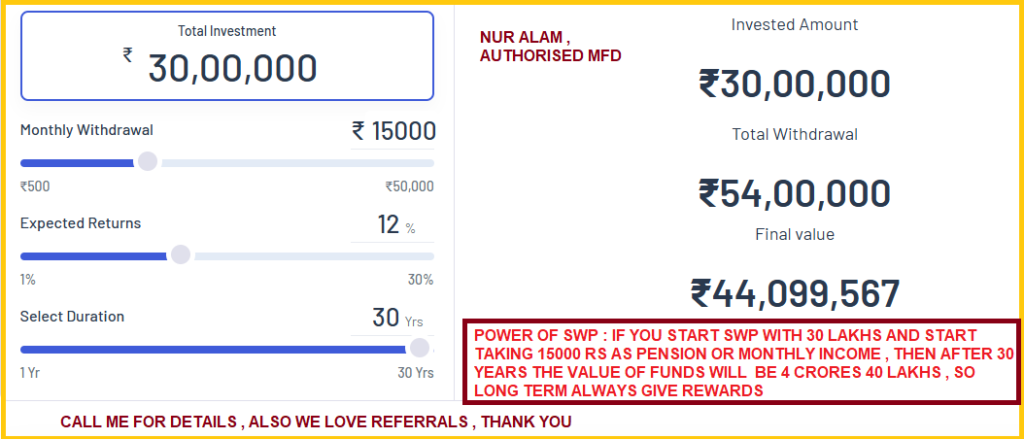

Below is the illutrations :

Here If a person invest onetime amount 30 lakhs rupees which he got after retirement or selling property , and kept in a mutual funds which gives 12% annual returns , then after 30 years the amount he will get is 4 crores and 40 lakhs in addition till 30 years he will withdraw a amount of 54 lakhs as monthly pensions.

This is the power of SWP investment for long term.

Here’s a more detailed breakdown:

1. Setting up the SWP:

- Investors specify the desired withdrawal amount and the frequency (e.g., monthly, quarterly).

- They can choose to withdraw a fixed amount or withdraw gains on their investment, keeping the principal intact.

2. Withdrawal Process:

- The fund house redeems the required number of units from the investor’s mutual fund holdings to generate the withdrawal amount.

- This amount is then transferred to the investor’s bank account.

3. Ongoing Investment:

- The remaining investment continues to grow based on the performance of the mutual fund scheme.

- This allows investors to benefit from potential market growth while simultaneously receiving a steady income stream.

4. Flexibility and Benefits:

- Investors can adjust the withdrawal amount or frequency as needed.

- SWPs are particularly useful for retirees or those seeking regular income from their investments.

- They can help manage capital gains more effectively and mitigate the impact of market volatility.

FAQ :

- What are the disadvantages of SWP?

What are the disadvantages of SWP? The main disadvantage of SWP is that it can deplete your investment if withdrawals continue for a long period, especially if your returns are lower than expected. Additionally, if you withdraw a large portion of your corpus, it can impact the growth of your remaining investments.

2. What is the 4 rule for SWP?

The “4% rule” for a Systematic Withdrawal Plan (SWP) suggests withdrawing 4% of your initial investment corpus in the first year of retirement, and then increasing that withdrawal by the inflation rate in subsequent years. This rule aims to help retirees ensure their retirement savings last for a sustained period, potentially 30 years or more.

3. Which one is better, FD or SWP?

SWP Vs FD: Why An SWP Win Hands Down

| Factor | FDs | SWP |

|---|---|---|

| Liquidity | Low (Lock-in period) | High (Flexible withdrawals) |

| Growth potential | Low | High |

| Inflation adjustment | No | Yes |

| Wealth preservation | No | Yes |

4. Which is better, SIP or SWP?

SIPs are good for long-term growth, and it’s best to start as early as possible. SWPs are good for people who don’t have time to manage their investments, or who want to enjoy the fruits of their labor. The rising popularity of mutual fund investments has prompted investor curiosity about various related terms.

5. Is SWP tax free?

For investors seeking regular income, the Dividend option or an SWP is beneficial. With the Dividend option, the fund house deducts a 10% Dividend Distribution Tax (DDT) at the source. No additional tax is levied on the received dividend. Alternatively, with an SWP, no tax is deducted at the source.

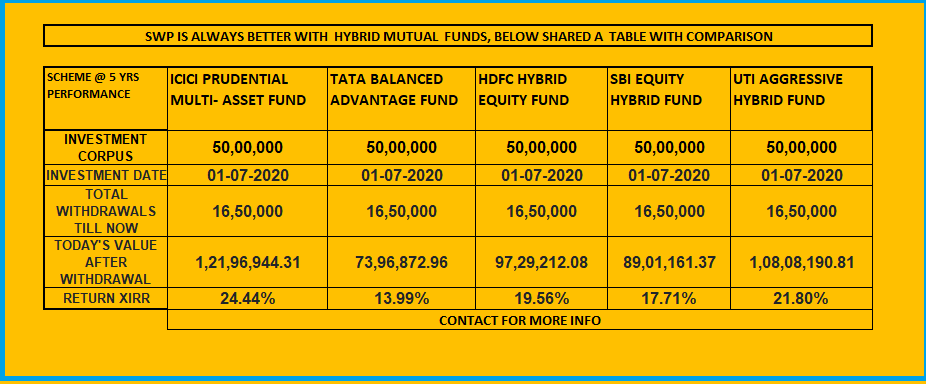

Details of Previous SWP plan :

6. What is the thumb rule for SWP?

The way to start off with this rough thumb rule would be that you should at least have 25 times your annual money requirement as your portfolio size to build a good monthly income kind of a solution. So, if you want Rs 1 lakh every month, then for an entire year you will require 12 lakhs. So amount you required to start SWP is 25 x 1200000 Rs =30000000 Rs ie 3 crores .

Notes : Article is wriiten by authorised MFD. Belwo is his Mutual Fund opening link.

For more info one can contact

nuralamahmed14@gmail.com or fill the Google form

Also read :

1 thought on “Power of Systematic Withdrawal Plan (SWP)”