Bikaji Foods IPO details :

About the Bikaji Foods Limited :

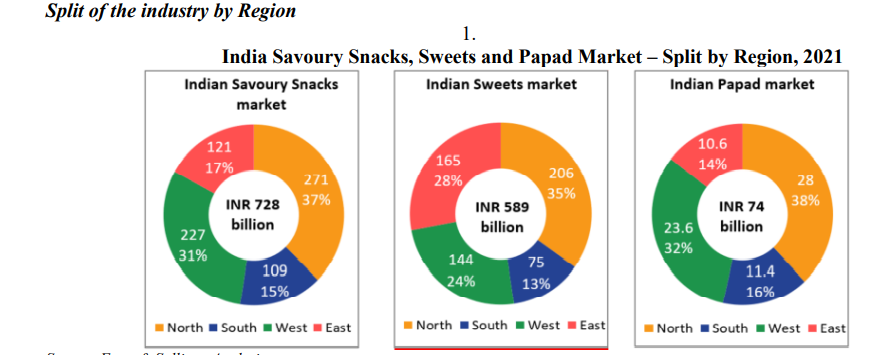

Bikaji Foods International Limited is one of India’s largest fast-moving consumer goods (“FMCG”) brands. The company’s product range includes six principal categories: bhujia, namkeen, packaged sweets, papad, western snacks as well as other snacks which primarily include gift packs (assortment), frozen food, mathri range and cookies. In the six months that ended June 30, 2022, the company sold more than 300 products under the Bikaji brand.

Company was originally incorporated as “Shivdeep Industries Limited” as a public limited company under the Companies Act, 1956 at Bikaner, pursuant to a certificate of incorporation dated October 6, 1995 issued by the Registrar of Companies, Rajasthan at Jaipur (“RoC”) and received a certificate of commencement of business from the RoC on October 27, 1995, following our conversion from the erstwhile partnership firm, “Shivdeep Food Products” to

“Shivdeep Industries Limited”. Subsequently, the name of our Company was changed from “Shivdeep Industries Limited” to “Bikaji Foods International Limited” pursuant to the Shareholders’ resolution dated September 8, 2011 and a fresh certificate of incorporation issued by RoC recording the change in name was issued on October 5, 2011. For further details including in relation to changes in name and registered office of our Company website.

The company was the largest manufacturer of Bikaneri bhujia with an annual production of 29,380 tonnes, and we were the second largest manufacturer of handmade papad with an annual production capacity of 9,000 tonnes in Fiscal 2022. The company has an international footprint, selling Indian snacks and sweets, and is among the fastest-growing companies in the Indian organised snacks market.

The company has over the years established market leadership in the core states of Rajasthan, Assam and Bihar with an extensive reach. It has gradually expanded its footprint across India, with operations across 23 states and three union territories as of June 30, 2022.

In the six months ended June 30, 2022, The company has exported the products to 21 international countries, including North America, Europe, the Middle East, Africa, and Asia Pacific, representing 3.20% of our sales of food products in such period.

Bikaji Foods International Limited has six operational manufacturing facilities that are operated by us, with four facilities located in Bikaner (Rajasthan), one in Guwahati (Assam), one facility in Tumakuru (Tumkur) (Karnataka) held through the subsidiary Petunt Food Processors Private Limited to cater to the southern markets in India.

See details video of Bikiaji Foods IPO , subscribe for regular updates:

Strenghts of Bikaji Foods :

- Well-established brand with pan-India recognition.

- Diversified product portfolio focused on various consumer segments and markets.

- Strategically located, large-scale sophisticated manufacturing facilities with stringent quality standards.

- Extensive pan-India and global distribution network, arrangements with reputed retail chains and growing eCommerce and exports channel.

- Extensive distribution network in India.

- Strategic arrangements with retail chains in India and international markets.

- Growing e-commerce channel.

- Significant multi-product export sales.

Weakness of Bikaji Foods :

Key restraints for Indian Savoury Snacks and sweets industry

- Increase in price of raw material

- Availability problem of some raw materials for seasonal production.

- High cost of packaging

- Long and fragmented supply chain

- Inadaptability of using technology for production and distribution

- Adulteration by unorganized players

- Low shelf life of product

- Mee too product affecting brand credibility.

Bikaji Foods IPO Details

| Bikaji Foods IPO Dates | 3 – 7 November 2022 |

| Bikaji Foods IPO Price | 285-300 |

| Fresh issue | Nil |

| Offer For Sale | 29,373,984 shares |

| Total IPO size | 29,373,984 shares |

| Minimum bid (lot size) | 15000 rs for 50 shares |

| Face Value | INR 1 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Bikaji Foods Financial Performance

| FY 2019 | FY 2020 | FY 2021 | H1 FY 2022 | |

| Revenue | 901.4 | 1,074.6 | 1,310.7 | 771.7 |

| Expenses | 834.8 | 1,019.3 | 1,202.1 | 721.4 |

| Net income | 50.3 | 65.2 | 81.5 | 41.7 |

| Margin (%) | 5.58 | 6.07 | 6.22 | 5.40 |

Figures in INR crore unless specified otherwise

Bikaji Foods Offer News

Bikaji Foods Valuations & Margins

| FY 2019 | FY 2020 | FY 2021 | |

| EPS | 2.11 | 2.32 | 3.71 |

| PE ratio | – | – | – |

| RONW (%) | 10.84 | 10.65 | 14.93 |

| NAV | – | – | 24.85 |

| ROCE (%) | 16.55 | 12.79 | 20.88 |

| EBITDA (%) | 10.35 | 8.80 | 11.04 |

| Debt/Equity | 0.15 | 0.10 | 0.14 |

As per Consolidated Financial Information

Bikaji Foods IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 28 Oct 2022 | 80 | – | – |

Bikaji Foods IPO Subscription – Live Updates

| Category | Shares Offered | Day 1 | Day 2 | Day 3 |

| QIB | ||||

| NII | ||||

| Retail | ||||

| Employee | ||||

| Total |

Subscription figures in number of times, at 5 PM

Bikaji Foods Offer Registrar

Link Intime India Private Limited

C-101, 1st Floor, 247 Park

L.B.S. Marg, Vikhroli West

Mumbai – 400 083, Maharashtra

Phone: +91 22 4918 6200

Email: bikaji.ipo@linkintime.co.in

Website: www.linkintime.co.in

Bikaji Foods Contact Details

Bikaji Foods International Limited

Plot No. E-558-561,

C -569-572, E -573-577,

F-585-592, Karni Extension,

RIICO Industrial Area,

Bikaner – 334 004 Rajasthan

Phone: +91 151 2259914

Email: cs@bikaji.com

Website: www.bikaji.com

Also read : Open Upstox Account (How to Open ? Upstox Account Opening Process, Documents and Charges)

Bikaji Foods IPO Allotment Status

Bikaji Foods IPO allotment will be available on Link Intime’s website. Click on this link to get allotment status.