Let’s discuss about ICICI Prudential Asset Management IPO.

About ICICI Prudential Asset Management

Incorporated in 1993, ICICI Prudential AMC is an Asset Management Company. Its investment approach has always been to manage risk first and aim for long term returns for their customers.

ICICI Prudential Asset Management Company is India’s largest asset manager by active mutual fund QAAUM with a 13.3% market share and ₹10.1 trillion in mutual fund assets as of September 30, 2025. With a 30-year legacy in the investment management industry, the company maintains leadership across equity and equity-oriented hybrid categories and holds the highest share of individual investor MAAUM in the country. It manages 143 mutual fund schemes across equity, debt and passive strategies, and follows a risk-first investment philosophy focused on long-term wealth creation, supported by a nationwide customer base of 15.5 million investors.

In addition to mutual funds, the company manages a fast-growing alternates business offering PMS, AIFs and offshore advisory services, with total alternates QAAUM of ₹729.3 billion.

Services In Shorts :

- Mutual Fund Business: Equity and Equity Oriented Schemes, Debt schemes, Exchange-traded funds and index schemes, Arbitrage schemes and Liquid and overnight schemes.

- Portfolio Management Business: ICICI Prudential PMS Contra Strategy, ICICI Prudential PMS PIPE Strategy, ICICI Prudential PMS Growth Leaders Strategy, ICICI Prudential PMS Value Strategy, ICICI Prudential PMS Large Cap Strategy, ICICI Prudential PMS ACE Strategy.

- Alternative Investment Fund Business: Offer multiple offerings across Category II and Category III alternative investment funds registered with SEBI. These offerings cater to diverse needs of sophisticated investors for asset allocation.

As of September 30, 2025, the company has 3,541 full-time employees.

Strengths

- Strong brand backed by ICICI Bank and Prudential Group.

- Diversified product portfolio across equity, debt, hybrid funds.

- Large and growing assets under management with strong inflows.

- Extensive distribution network across India, including digital platforms.

- Experienced management team with deep industry expertise.

Risks

Cybersecurity risks due to increasing digital platform reliance.

- Largest asset management company in India in terms of assets managed under active mutual fund schemes

- Largest Individual Investor franchise in India in terms of mutual fund assets under management

- Diversified product portfolio across asset classes

- Pan-India, multi-channel and diversified distribution network

- Consistent profitable growth track record

- Experienced management and investment team

| Contact Details ICICI Prudential Asset Management Co.Ltd. Address 12 th Floor, Narain Manzil, 23, Barakhamba Road, Delhi, New Delhi, 110001 Phone: 91 022 2651 5000 Email: amcinvestors@icicipruamc.com Website: http://www.icicipruamc.com/ |

| IPO Date | Fri, Dec 12, 2025 to Tue, Dec 16, 2025 |

| Listing Date | [December 19 ,2025] |

| Face Value | ₹1 per share |

| Price Band | ₹2061 to ₹2165 |

| Lot Size | 6 Shares |

| Sale Type | Offer For Sale |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Total Issue Size | 4,89,72,994 shares (aggregating up to ₹10,602.65 Cr) |

ICICI Prudential AMC IPO Timeline (Tentative Schedule)

ICICI Prudential AMC IPO opens on Fri, Dec 12, 2025, and closes on Tue, Dec 16, 2025.

| IPO Open Date | Fri, Dec 12, 2025 |

| IPO Close Date | Tue, Dec 16, 2025 |

| Tentative Allotment | Wed, Dec 17, 2025 |

| Initiation of Refund | Thu, Dec 18, 2025 |

| Credit of Shares to Demat | Thu, Dec 18, 2025 |

| Tentative Listing Date | Fri, Dec 19, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Tue, Dec 16, 2025 |

Company Financials

ICICI Prudential Asset Management Co.Ltd. Financial Information (Restated)

ICICI Prudential Asset Management Co.Ltd.’s revenue increased by 32% and profit after tax (PAT) rose by 29% between the financial year ending with March 31, 2025 and March 31, 2024.

| Period Ended | 30 Sep 2025 | 31 Mar 2025 | 30 Sep 2024 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|---|

| Assets | 4,827.00 | 4,384.00 | 4,097.00 | 3,554.00 | 2,805.00 |

| Total Income | 2,949.00 | 4,980.00 | 2,458.00 | 3,761.00 | 2,838.00 |

| Profit After Tax | 1,618.00 | 2,650.00 | 1,327.00 | 2,050.00 | 1,516.00 |

| EBITDA | 2,210.00 | 3,637.00 | 1,838.00 | 2,780.00 | 2,073.00 |

| NET Worth | 3,921.50 | 3,517.00 | 3,272.00 | 2,883.00 | 2,313.00 |

| Reserves and Surplus | 3,904.00 | 3,433.00 | 3,254.00 | 2,799.00 | 2,229.00 |

| Amount in ₹ Crore and in round figure | |||||

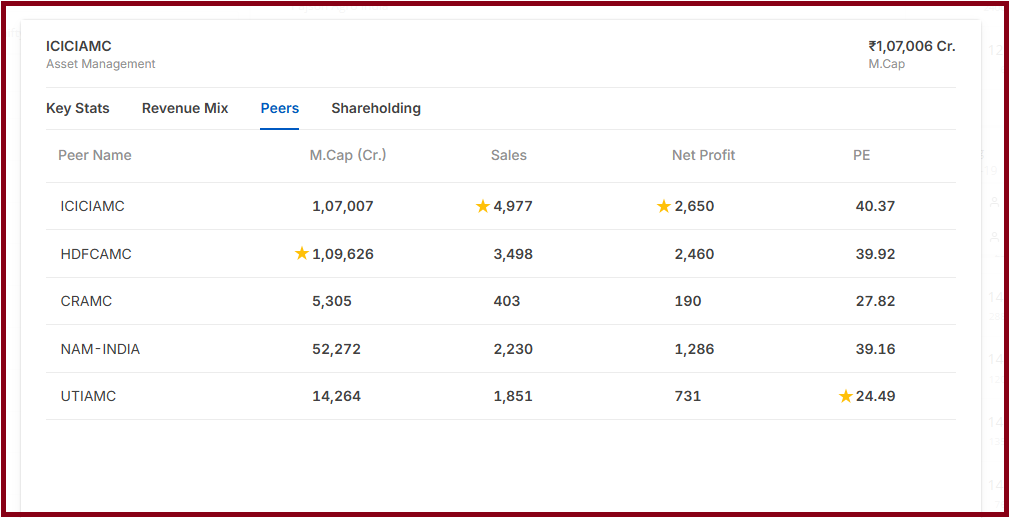

Peer Comparison:

ICICI Prudential AMC IPO FAQs

What is ICICI Prudential AMC IPO?

IPO details: The issue is an entirely Offer-for-Sale (OFS) of over 4.89 crore equity shares by promoter — UK-based Prudential Corporation Holdings, with no fresh issue component, according to a public announcement made by ICICI Prudential AMC.

Does ICICI Prudential AMC IPO have shareholder quota?

The IPO has a dedicated shareholder quota for ICICI Bank shareholders. Around 24.5 lakh shares have been earmarked for investors who hold ICICI Bank shares as of the cut-off date mentioned in the RHP.

Is ICICI Prudential IPO good?

While margin has remain flat, ICICI Prudential’s margin position is stronger than most peers, supported by cost discipline and the scale of its high-yield equity book. ICICI Prudential AMC leads not only in overall QAAUM but also across categories.

What is the grey price in IPO?

Grey Market Premium (GMP) is a good way to gauge the market sentiment for an Initial Public Offering (IPO) before it’s listed on the stock exchange. IPO GMP refers to the difference between the price at which shares are traded in the grey market and the issue price set by the company.

Is IPO allotment luck based?

Yes, IPO allotment is partly luck-based, especially for oversubscribed issues, because a lottery system is often used to allocate shares to retail investors. While you can’t guarantee a successful allotment, you can improve your chances by applying correctly and strategically, and avoiding common mistakes like multiple applications with the same PAN.

Also read :